DevOps in financial services has brought in the much-needed revolution in the BFSI industry and helped shed its age-old, traditional, and siloed practices and replace them with modern, agile, and integrated systems that helped the finance industry immensely. Even though the financial services industry has brought in some reforms in its decades-old practices and procedures during the beginning of the millennium, it is rather reluctant and slow. This is because most of the industries in the BFSI sector were not ready to test the new technologies such as DevOps as they are safe with their traditional fool-proof practices and procedures. It is only after the new technologies have proved themselves of being safe, agile, and better than the traditional ones that DevOps adoption in the finance industry has started. As the world is turning digital by the day, the pressure to meet the ever-changing demands and expectations of the customers, coupled with the competition from the new fintech start-ups that are backed by revolutionary new technologies offering varied and diversified services at a faster pace, traditional financial services have realized the urgent need for reformation. If one good thing has come out of the pandemic, it is the acceleration of the financial services sector into a digital age. During the pandemic where physical contact is limited and everything is restricted, financial services such as banks had to quickly adapt to a new business model that can meet customers’ needs and seamless operations of the financial institutions. Implementing DevOps in the banking sector is the easiest and safest way to achieve this paradigm shift that helped both customers and the so finance industry in modernizing its operations.

Why DevOps?

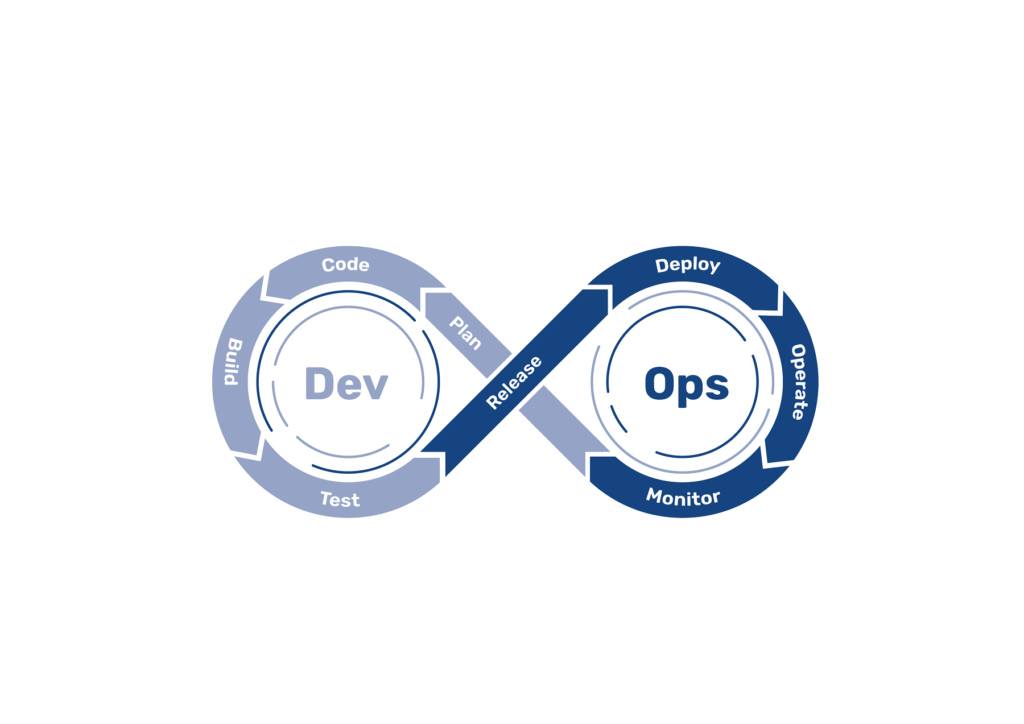

DevOps is a set of procedures or practices that bring together the software development team and the IT operations team together to provide continuous delivery while shortening the software development life cycle. Most businesses these days are required to continuously deliver software updates in tune with the end-users requirements and also in bringing new products to them, to stay ahead of the competition.

Financial services are no different. Financial institutions are facing immense pressure from demanding customers for fast, efficient, convenient, and safe services, and adopting DevOps in financial services can exactly meet all the requirements that are demanded by today’s digital economy! DevOps adoption in the finance industry has brought some unforeseen ease in doing business for the financial sector and excellent comfort for the consumers of the financial products. For example, adopting DevOps in the banking sector has significantly lessened the time taken to bring new financial products to the consumers like digital banking services. The general public is quick to adapt to these digital banking and financial services as they are not only fast, convenient, and safe, but also present the option of transacting from anywhere without visiting a financial institution. This digital shift would have taken much longer for the financial companies had they not let go of their legacy systems and procedures by adopting DevOps in the financial services industries. Let’s take a look at some of the major areas where the financial industries have gained in adopting DevOps.

Automation of Processes

Traditional legacy processes and procedures in finance industry don’t hold well in the new age digital economy where the faster you bring a new product to the market, the faster you reap the benefits of the same. Adopting DevOps in banking sector and other financial services help these enterprises deliver continuous software releases and updates.

Automation of all the processes in the software delivery pipeline is essential for continuous delivery as it optimizes resource utilization, software team productivity, and improved product quality. DevOps make sure that all the processes in the software cycle are automated end to end in a single centralized platform eliminating the time-consuming, repetitive tasks. This automation of all the processes in DevOps helps enterprises monitor the progress of releases and provides ways to optimize them as they evolve during each iteration, which leads to faster releases while ensuring scalability and compliance. Adopting DevOps in financial services has helped these enterprises automate all of their internal processes which resulted in smooth functioning, visibility, and speed in all the processes.

Cultural Collaboration

Automation of all the processes in the software delivery pipeline is essential for continuous delivery as it optimizes resource utilization, software team productivity, and improved product quality. DevOps make sure that all the processes in the software cycle are automated end to end in a single centralized platform eliminating the time-consuming, repetitive tasks. This automation of all the processes in DevOps helps enterprises monitor the progress of releases and provides ways to optimize them as they evolve during each iteration, which leads to faster releases while ensuring scalability and compliance. Adopting DevOps in financial services has helped these enterprises automate all of their internal processes which resulted in smooth functioning, visibility, and speed in all the processes.

One of the advantages of DevOps adoption in finance industry is it brings various teams together as one in achieving a common goal. In traditional financial services systems such as banks, various teams are often isolated which results in a loss of communication or miscommunication and visibility into the overall operations of the enterprise.

Adoption of DevOps in banking sector and other financial services require the collaboration of different teams such as business, development, operations, quality assurance, and various other teams to work closely by bringing them on to a single platform with a combined mission of delivering quality service to its customers. This cultural collaboration and knowledge sharing not only brightens the visibility of every operation but also facilitates the internal functioning of the enterprise.

Enhanced Security

The financial services industry is perhaps the biggest industry where a large number of transactions are being done every day. Security is obviously the highest priority and these enterprises have to comply with multiple security regulations and standards. This is one of the major reasons why financial institutions are reluctant toward digital transformation initially despite assurances by the DevOps services providers.

Financial services companies that went ahead in adopting DevOps have proved that the adoption has actually helped them reduce potential security problems by identifying potential security threats beforehand and tackling them in time. Also, DevSecOps, an enhanced DevOps variant with a full-fledged security process integrated into the system lifecycle was introduced and this has further strengthened the basis for DevOps adoption in the financial services industries.

Coherence to the top management

Financial services involve hundreds of processes involving thousands of workforce widely distributed across different geographical locations and this often leads to miscommunication among different teams, lack of coherence, and end-to-end visibility to the top management, all leading to delays in delivering efficient service to the customer.

Adopting DevOps will bring together various teams involving building, testing, deployment, and release of new software updates. This eliminates friction between various teams as each phase is fully orchestrated enabling shared visibility and control across all the processes and infrastructures. DevOps helps in the orchestration of each phase of the software delivery pipeline thus giving coherence and much-needed visibility into every aspect of all the operations to the top management.

The biggest roadblock to implementing DevOps in the financial services industry is that most financial enterprises still depend on traditional legacy systems, and lack of skilled tech workforce. But owing to the competition both from the traditional players who had thus adopted new tech trends and also from the new players in the field like Fintech companies that are tech-savvy, the financial services companies that are lagging behind are now looking for suitable DevOps services providers for overhauling their age-old systems with new, efficient, agile, safe, and secure systems!